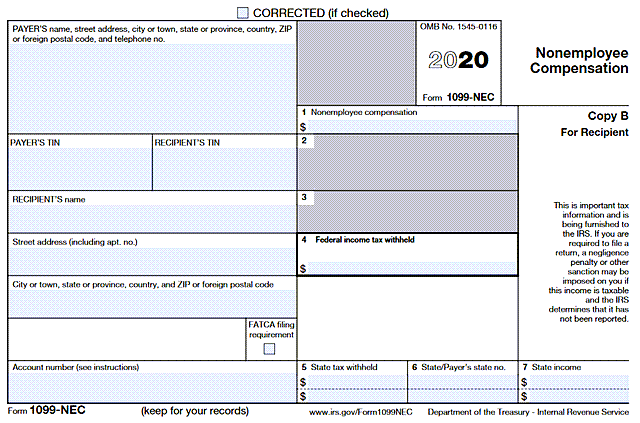

Are you ready for the 1099-NEC? As the tax season approaches, it is important for professionals to familiarize themselves with the new IRS form for second shooters and independent contractors. In the past, the 1099-MISC form was used to report non-employee compensation, but starting in 2020, the 1099-NEC form has replaced it.

What is the 1099-NEC Form for Nonemployee Compensation?

The 1099-NEC form is specifically designed to report payments made to non-employees for services rendered. It is important for businesses to file this form accurately and timely to avoid penalties. The form covers various types of payments such as fees, commissions, and prizes.

The 1099-NEC form is specifically designed to report payments made to non-employees for services rendered. It is important for businesses to file this form accurately and timely to avoid penalties. The form covers various types of payments such as fees, commissions, and prizes.

Independent contractors and freelancers should pay close attention to this new form, as it affects how their income will be reported to the IRS. It is crucial for them to understand the requirements and obligations associated with the 1099-NEC form.

Why Was the 1099-NEC Form Introduced?

The introduction of the 1099-NEC form was prompted by the need for clearer reporting of non-employee compensation. The previous 1099-MISC form covered a broader range of payments, making it difficult to distinguish between different types of income. By separating non-employee compensation into its own form, the IRS aims to streamline the reporting process and improve data accuracy.

The introduction of the 1099-NEC form was prompted by the need for clearer reporting of non-employee compensation. The previous 1099-MISC form covered a broader range of payments, making it difficult to distinguish between different types of income. By separating non-employee compensation into its own form, the IRS aims to streamline the reporting process and improve data accuracy.

Important Considerations for Second Shooters and Independent Contractors

If you are a second shooter or an independent contractor, it is crucial to understand your tax obligations regarding the 1099-NEC form. Here are a few key points to keep in mind:

If you are a second shooter or an independent contractor, it is crucial to understand your tax obligations regarding the 1099-NEC form. Here are a few key points to keep in mind:

- Ensure that your clients are aware of the new form: Communicate with your clients and make sure they are aware of the change from the 1099-MISC to the 1099-NEC form. This will help avoid any confusion or potential mistakes on their end.

- Keep accurate records of your income: As a non-employee, it is important to maintain accurate records of your earnings throughout the year. This will make it easier to fill out the 1099-NEC form when the time comes.

- Understand the deadlines: Familiarize yourself with the deadlines for filing the 1099-NEC form. The form must be provided to recipients by January 31st and filed with the IRS by the last day of February if filing by paper or March 31st if filing electronically.

How Can QuickBooks Help with the 1099-NEC?

Using accounting software like QuickBooks can simplify the process of generating and filing the 1099-NEC form. QuickBooks has updated its software to accommodate the new form and has provided comprehensive guidelines to assist users in adapting to the changes.

Using accounting software like QuickBooks can simplify the process of generating and filing the 1099-NEC form. QuickBooks has updated its software to accommodate the new form and has provided comprehensive guidelines to assist users in adapting to the changes.

QuickBooks users can easily track and categorize non-employee compensation throughout the year, making it easier to generate accurate 1099-NEC forms at tax time. The software also provides e-filing options, reducing the likelihood of any errors or delays.

Conclusion

The introduction of the 1099-NEC form has changed the way non-employee compensation is reported to the IRS. Second shooters, independent contractors, and businesses that hire them must familiarize themselves with the new form and ensure compliance with the filing requirements. Using accounting software such as QuickBooks can greatly simplify the process and help avoid any potential errors or penalties. Stay informed and prepared for the 1099-NEC to keep your tax obligations in check.

Note: This article provides a general overview of the 1099-NEC form and its implications. Always consult with a tax professional for personalized guidance and advice based on your specific circumstances.

Note: This article provides a general overview of the 1099-NEC form and its implications. Always consult with a tax professional for personalized guidance and advice based on your specific circumstances.