A 1099 form is an essential document for individuals and businesses alike when it comes to reporting various types of income and payments. Whether you are a freelancer, a small business owner, or an independent contractor, understanding the purpose and importance of a 1099 form is crucial. In this article, we will explore the concept of a 1099 form, its different types, and how to properly fill it out.

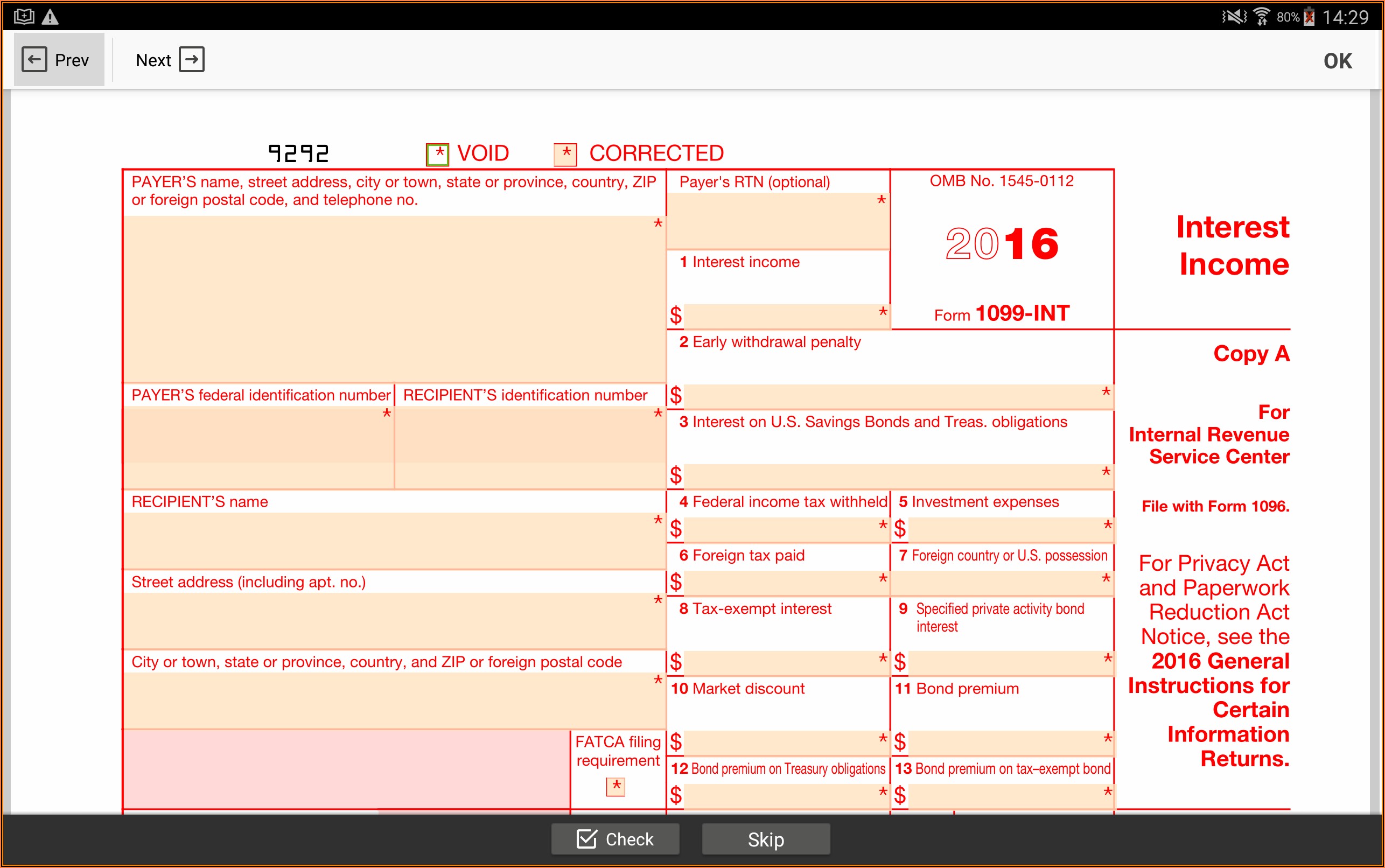

- Fillable Form 1099

One of the most common types of 1099 forms is the Fillable Form 1099. This form allows you to report interest income that you have received throughout the year. Whether you earned interest from a bank account or a financial institution, it is important to accurately report this income to the IRS.

One of the most common types of 1099 forms is the Fillable Form 1099. This form allows you to report interest income that you have received throughout the year. Whether you earned interest from a bank account or a financial institution, it is important to accurately report this income to the IRS.

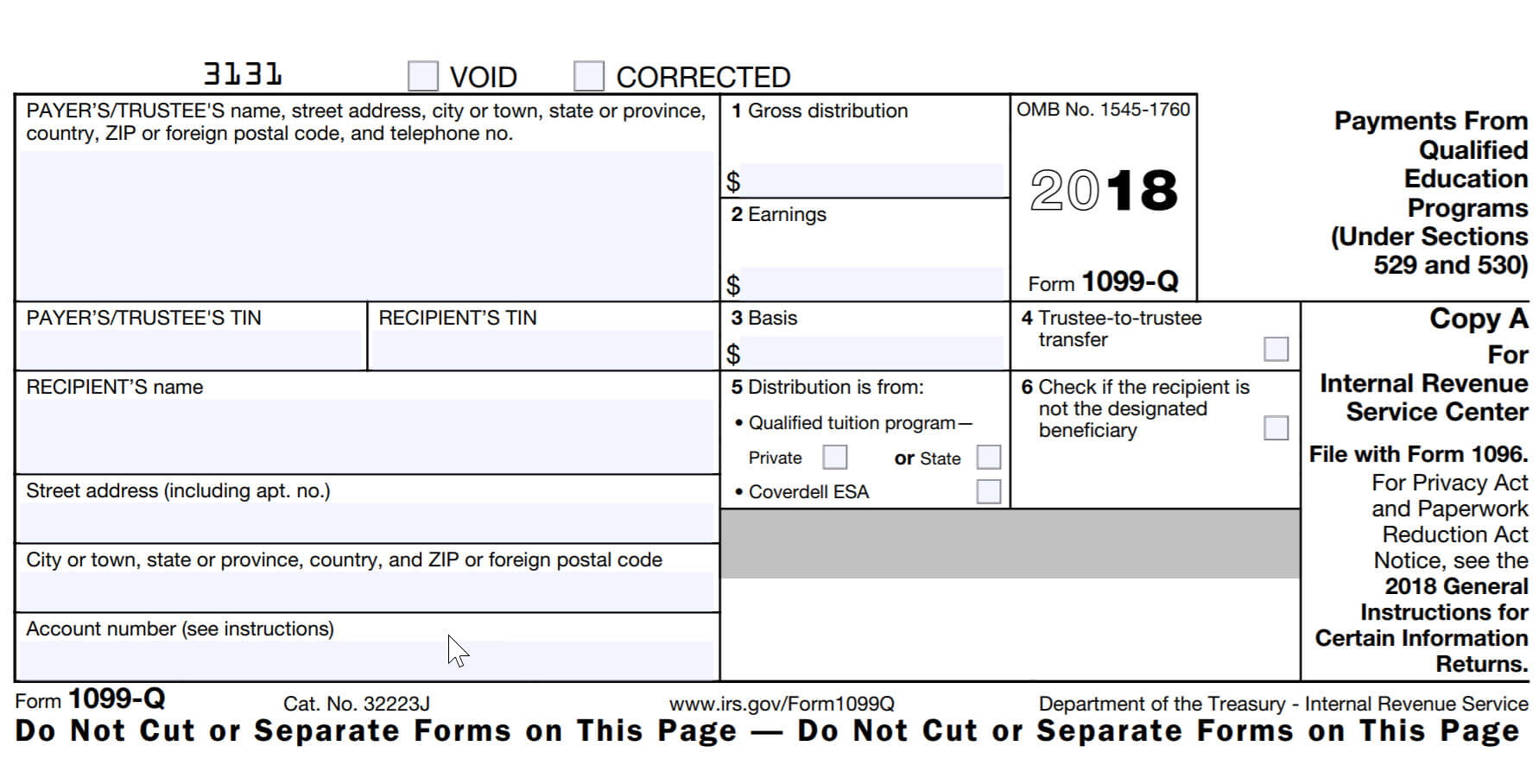

- 1099 Form Printable 2018

If you prefer a physical copy of the 1099 form, the 1099 Form Printable 2018 is a convenient option. This printable form allows you to manually fill out the necessary information and then submit it to the IRS. It is important to ensure that all the information is legible and accurate to avoid any potential issues with your tax return.

If you prefer a physical copy of the 1099 form, the 1099 Form Printable 2018 is a convenient option. This printable form allows you to manually fill out the necessary information and then submit it to the IRS. It is important to ensure that all the information is legible and accurate to avoid any potential issues with your tax return.

- Printable 1099 Tax Forms Free

For those who prefer a user-friendly and readily available option, the Printable 1099 Tax Forms Free are an excellent choice. You can easily access and print these forms from the comfort of your own home or office. Make sure to complete the forms accurately and include all the necessary information before submitting them.

For those who prefer a user-friendly and readily available option, the Printable 1099 Tax Forms Free are an excellent choice. You can easily access and print these forms from the comfort of your own home or office. Make sure to complete the forms accurately and include all the necessary information before submitting them.

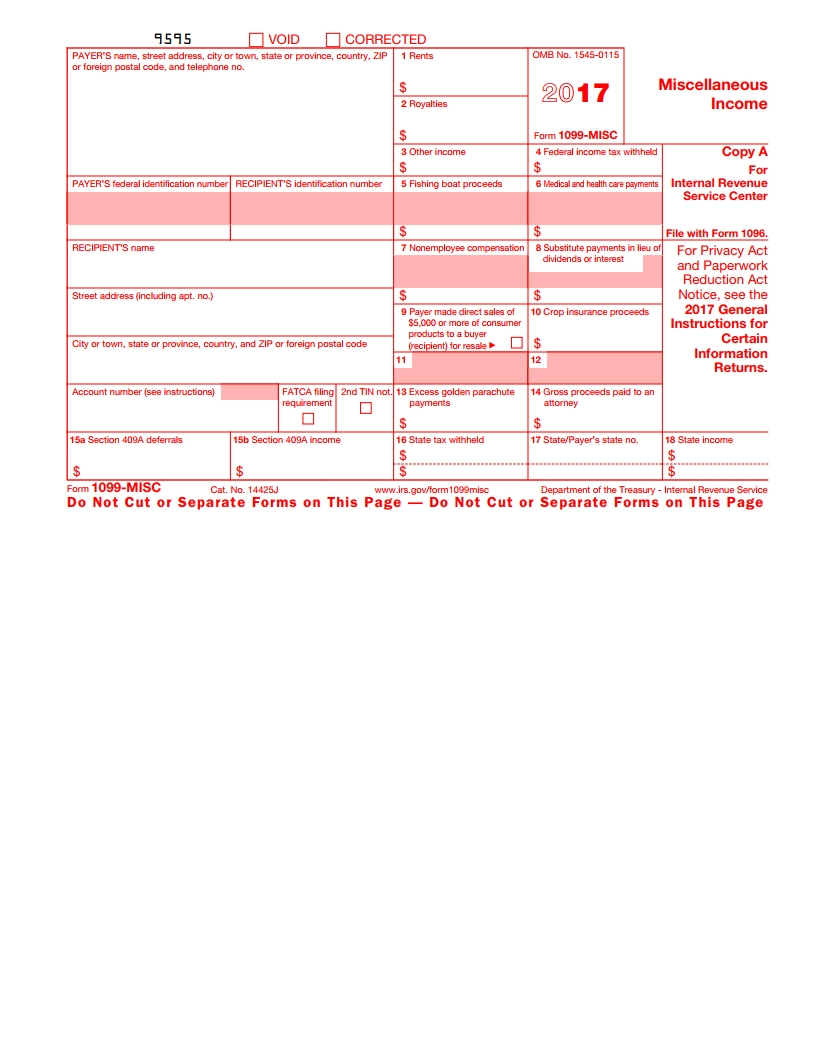

- What Is Form 1099-MISC?

The 1099-MISC form is specifically designed for reporting miscellaneous income that you have received throughout the year. This can include payments for freelance work, rents, prizes, awards, and other forms of miscellaneous income. It is important to note that there are specific requirements and thresholds for when you need to file a 1099-MISC form.

The 1099-MISC form is specifically designed for reporting miscellaneous income that you have received throughout the year. This can include payments for freelance work, rents, prizes, awards, and other forms of miscellaneous income. It is important to note that there are specific requirements and thresholds for when you need to file a 1099-MISC form.

- 1099-MISC Form - Printable and Fillable PDF Template

For those who prefer using digital forms, the 1099-MISC Form - Printable and Fillable PDF Template is a great option. This template allows you to fill out the form electronically, ensuring accuracy and ease of submission. Simply enter the required information, save the completed form, and submit it to the IRS.

For those who prefer using digital forms, the 1099-MISC Form - Printable and Fillable PDF Template is a great option. This template allows you to fill out the form electronically, ensuring accuracy and ease of submission. Simply enter the required information, save the completed form, and submit it to the IRS.

- Free Printable 1099 Misc Forms

If you are looking for a cost-effective option that also provides flexibility, Free Printable 1099 Misc Forms are the way to go. These forms can be downloaded and printed for free, allowing you to complete them in your own time and at your own pace. Ensure that you have entered all the necessary information accurately before submitting the forms to the IRS.

If you are looking for a cost-effective option that also provides flexibility, Free Printable 1099 Misc Forms are the way to go. These forms can be downloaded and printed for free, allowing you to complete them in your own time and at your own pace. Ensure that you have entered all the necessary information accurately before submitting the forms to the IRS.

- Form 1099

Form 1099 is a versatile document that encompasses various types of income and payments. It is important to understand the specific type of income you need to report and select the appropriate form accordingly. Filling out the form accurately and submitting it on time will ensure compliance with IRS regulations and avoid any penalties or fines.

Form 1099 is a versatile document that encompasses various types of income and payments. It is important to understand the specific type of income you need to report and select the appropriate form accordingly. Filling out the form accurately and submitting it on time will ensure compliance with IRS regulations and avoid any penalties or fines.

- Free Printable 1099 Misc Forms

Free Printable 1099 Misc Forms provide small business owners and freelancers with a convenient option to report miscellaneous income. These forms are tailored to meet the specific needs of entrepreneurs and self-employed individuals, making it easier to accurately report income and comply with IRS requirements. Make sure to review the instructions carefully and complete the forms accurately.

Free Printable 1099 Misc Forms provide small business owners and freelancers with a convenient option to report miscellaneous income. These forms are tailored to meet the specific needs of entrepreneurs and self-employed individuals, making it easier to accurately report income and comply with IRS requirements. Make sure to review the instructions carefully and complete the forms accurately.

- What Is a 1099 Form, and How Do I Fill It Out?

Understanding the purpose and process of filling out a 1099 form is essential for every taxpayer. This comprehensive form is designed to report various types of income, including self-employment income, interest income, and dividend income. Familiarize yourself with the different sections of the form, gather all the necessary information and documentation, and accurately fill out the form to ensure compliance with IRS regulations.

Understanding the purpose and process of filling out a 1099 form is essential for every taxpayer. This comprehensive form is designed to report various types of income, including self-employment income, interest income, and dividend income. Familiarize yourself with the different sections of the form, gather all the necessary information and documentation, and accurately fill out the form to ensure compliance with IRS regulations.

- E-File 1099

E-Filing your 1099 forms offers a convenient and efficient way to report income to the IRS. With electronic filing options, such as E-File 1099, you can submit your forms quickly and securely. Take advantage of technology and simplify your tax filing process by utilizing reputable e-filing services.

E-Filing your 1099 forms offers a convenient and efficient way to report income to the IRS. With electronic filing options, such as E-File 1099, you can submit your forms quickly and securely. Take advantage of technology and simplify your tax filing process by utilizing reputable e-filing services.

In conclusion, understanding the importance of 1099 forms and how to properly fill them out is crucial for individuals and businesses. Whether you choose to use fillable forms, printable forms, or electronic filing options, accuracy and compliance with IRS regulations are paramount. By familiarizing yourself with the various types of 1099 forms and utilizing the appropriate resources, you can ensure smooth tax filing and avoid potential issues with the IRS.