Are you ready for the year-end tax season? It’s that time of the year again when businesses and individuals alike prepare to file their taxes and ensure compliance with the Internal Revenue Service (IRS). One important form that you may need to be familiar with is the 1099 form, specifically the 1099-NEC and 1099-MISC forms. Let’s dive into what these forms are and why they are essential.

Form 1099-NEC: The New Kid on the Block

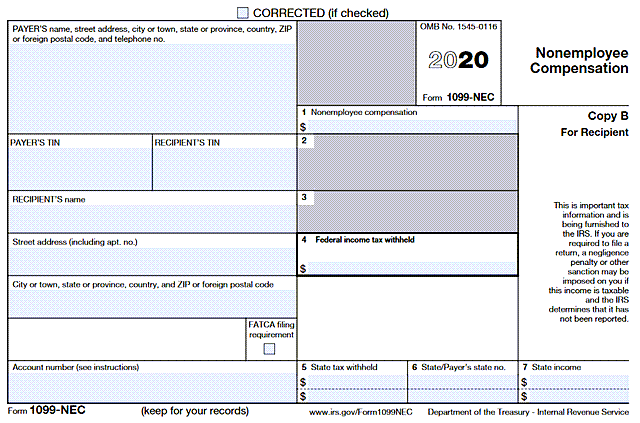

The Form 1099-NEC, which stands for Nonemployee Compensation, made a comeback in 2020 after a hiatus of nearly 40 years. Previously, nonemployee compensation was reported on Form 1099-MISC, but the IRS resurrected the Form 1099-NEC to streamline reporting.

The Form 1099-NEC, which stands for Nonemployee Compensation, made a comeback in 2020 after a hiatus of nearly 40 years. Previously, nonemployee compensation was reported on Form 1099-MISC, but the IRS resurrected the Form 1099-NEC to streamline reporting.

The Form 1099-NEC is used to report income earned by individuals who are not employees in the traditional sense. This includes independent contractors, freelancers, and individuals who provide services on a self-employed basis. If you paid an individual $600 or more for their services in 2020, you will likely need to issue them a Form 1099-NEC.

Understanding Form 1099-MISC

While the Form 1099-NEC takes care of reporting nonemployee compensation, the Form 1099-MISC still has its place. It is used to report various types of income, including rents, royalties, prizes, and awards, among others. If you made payments of $600 or more in these categories to an individual or business, you will need to issue them a Form 1099-MISC.

While the Form 1099-NEC takes care of reporting nonemployee compensation, the Form 1099-MISC still has its place. It is used to report various types of income, including rents, royalties, prizes, and awards, among others. If you made payments of $600 or more in these categories to an individual or business, you will need to issue them a Form 1099-MISC.

It’s important to remember that while the Form 1099-MISC includes nonemployee compensation reporting, you should only report nonemployee compensation on either the 1099-NEC or the 1099-MISC, but not both. Reporting nonemployee compensation on both forms can lead to duplicate reporting and potential discrepancies with the IRS.

What You Need to Know for 2020

The year 2020 brought about some significant changes to Form 1099 reporting. As mentioned earlier, the reintroduction of the 1099-NEC was a key development. Additionally, the deadline for filing Form 1099-MISC, which used to be January 31, has been aligned with the deadline for Form W-2, which is usually the end of February.

The year 2020 brought about some significant changes to Form 1099 reporting. As mentioned earlier, the reintroduction of the 1099-NEC was a key development. Additionally, the deadline for filing Form 1099-MISC, which used to be January 31, has been aligned with the deadline for Form W-2, which is usually the end of February.

Another notable change relates to the Box 7 reporting requirement on Form 1099-MISC. Previously, if you made payments of $600 or more to a nonemployee, you would report it in Box 7, which was reserved for nonemployee compensation. However, with the introduction of the 1099-NEC, nonemployee compensation is now reported on that separate form, and Box 7 on Form 1099-MISC is reserved specifically for direct sales of $5,000 or more of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

Why Accuracy is Key

Accurate and timely reporting on your 1099 forms is crucial to avoid penalties and to maintain compliance with IRS regulations. Failing to file or filing incorrect information can result in fines ranging from $50 to $550 per form, depending on how late the correction is made. Ensuring that you have the correct information from your vendors and contractors is essential to avoid these penalties.

Accurate and timely reporting on your 1099 forms is crucial to avoid penalties and to maintain compliance with IRS regulations. Failing to file or filing incorrect information can result in fines ranging from $50 to $550 per form, depending on how late the correction is made. Ensuring that you have the correct information from your vendors and contractors is essential to avoid these penalties.

To avoid errors, it’s recommended that you double-check all the information provided by your vendors and contractors. Make sure their names, addresses, Social Security numbers or taxpayer identification numbers, and payment amounts are accurately recorded. Additionally, keep detailed records of all payments made, including invoices, contracts, and receipts, for future reference.

Conclusion

As the year comes to an end, it’s essential to familiarize yourself with the requirements and changes in the 1099 form reporting for 2020. The reintroduction of the Form 1099-NEC and changes to the Form 1099-MISC mean that accurate reporting is crucial to avoid penalties. Be sure to gather all the necessary information from your vendors and contractors and file your forms on time to ensure compliance with IRS regulations. By staying informed and attentive to these requirements, you can navigate the year-end tax season smoothly and focus on what matters most – growing your business.

As the year comes to an end, it’s essential to familiarize yourself with the requirements and changes in the 1099 form reporting for 2020. The reintroduction of the Form 1099-NEC and changes to the Form 1099-MISC mean that accurate reporting is crucial to avoid penalties. Be sure to gather all the necessary information from your vendors and contractors and file your forms on time to ensure compliance with IRS regulations. By staying informed and attentive to these requirements, you can navigate the year-end tax season smoothly and focus on what matters most – growing your business.